Just before New Year’s Greetly shared its predictions for the co-working industry. With 2017 upon us, it’s time to check in on the current state of the co-working industry.

State of the Co-Working Industry

State of the Co-Working Industry

Small business owners and freelancers no longer wish to be tied down by a traditional office. The lease and environment zap productivity. Instead, many are shifting towards executive suites and co-working spaces.

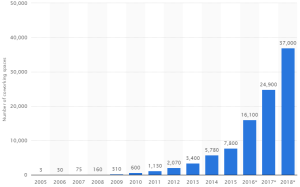

Statista says there were 7,800 co-working offices in 2005. While a drop in the bucket of the commercial real estate landscape, that number hovered around zero 10 years earlier. The industry will continue to grow exponentially, with 37,000 co-working spaces next year!

According to JLL, co-working spaces totaled 27-million square feet in 2016, with more than 10% of that space leased by operators with offices of 20,000 square feet or more.

In other words, size matters, and co-working space owners are aware. A Deskmag survey reported the following:

- 62% of co-working space owners in 2016 reported wanting to expand their spaces.

- 78% of profitable co-working space owners in 2016 reported wanting to expand their spaces.

- 36% of owners reported wanting to add a location.

- 27% of owners reported wanting to add additional space and desks at their current location.

- 12% of owners reported wanting to move from their current location to another location.

Customer Loyalty

A larger number of spaces and facilities produces competition. Here’s what you need to know about what tenants and members are planning.

- 80% of workspace renters plan on remaining with their current co-working space.

- 67% of renters haven’t even considered switching locations.

- 15% of co-working tenants work at more than one location.

New Customer Growth

Although attracting unsatisfied customers from other workspace locations could prove profitable, trends in the co-working industry show that attracting first-time customers remains more important. Take a look at the projections from Small Business Labs.

- The number of working spaces is projected to increase from 11,100 spaces in 2016 to over 26,000 spaces in 2020. That’s a 23% average annual increase compounded over four years.

- The number of global co-working members is projected to increase from about 976,000 in 2016 to just over 3.8 million in 2020. That’s a 41% average annual increase compounded over 4 years.

These numbers–a larger percentage increase in members than in working spaces–emphasize the trend to larger workspaces and the need for co-working space operators to maximize members per square foot.

Trends in Services

The same strategies exist for attracting and retaining new customers, switching customers, and current customers. Here are trends in services to help your co-working space remain at the front of the market.

The same strategies exist for attracting and retaining new customers, switching customers, and current customers. Here are trends in services to help your co-working space remain at the front of the market.

- Amenities are becoming more important. What separates the experience of your co-working space renters from the competition? In other words, what amenities are you providing? Many providers stock premium refreshments, host regular events and workshops, and help members network and collaborate, for example.

- Spaces offer flexibility. What lease options are available? Many renters, especially new renters, want to sign up and start working immediately. They do not, however, want to be tied down with long-term commitments. Many spaces use short-term leases of less than a year. Some offer spaces by the month, week, or even by the hour.

- Spaces become more professional. Building a coworking community is one of the primary reasons professionals rent an office. Shared work spaces that allow renters to greet clients in a professional manner are becoming more popular and necessary. Products such as Greetly’s coworking software, which greets customers at your small office, creates a professional environment. The app allows visitors to state who they are there to see, the purpose of their visit, and notifies the appropriate host employee.

- Spaces appeal to specific groups. Attracting niche audiences within a specific field, such as freelance writers, freelance photographers, young professionals, and others will help units retain and attract specific renters. We’ve recently seen the introduction of co-working facilities targeting working moms and (separately) the cannabis industry, for example.

Summary: The Sustainability of Coworking Industry Growth

Can such rapid growth be sustained? The co-working space concept undeniably appeals to millennials and an emerging entrepreneurial workforce. And even though market experts project dramatic growth over the next four years, co-working spaces still only make up a small market share in relation to traditional offices.

Forecasters admit that the co-working industry has not experienced an economic downturn. In addition, as the industry grows so does exposure to market fluctuations.

As long as space operators innovate with their offerings and provide coworking space management software attractive to technology companies and independent workers, like Greetly’s iPad receptionist, the industry should continue to thrive.